In urban areas, both for last kilometer delivery and for long-distance haulage, regulations on CO2 emissions are tightening, encouraging goods transport players to switch to decarbonized forms of energy. But fleet renewal is slow. Against all expectations, the Covid-19 crisis could accelerate the sector’s energy transition!

That haulers are preoccupied with reducing their greenhouse gas and pollutant emissions is nothing new! For decades now they have been engaged in doing just that by changing their practices and modernizing their truck (permissible laden weight > 3.5 t) and light van (LDV) fleets. The results achieved in the period 1990-2019 are far from negligible, especially in terms of the reduction in the principal atmospheric pollutants:

| Change in emissions 1990-2019 |

% emissions (trucks+ LDV) compared with total emissions in France (2019) |

||

| Trucks | LDV | ||

| Nitrogen oxides (NOx) | - 75% | - 32% | 26% (17% + 9%) |

| Carbon monoxide (CO) | - 76% | - 95% | 4% (2% + 2%) |

| Particles PM10 | - 74% | - 71% | 5% (2% + 3%) |

| Particles PM2.5 | - 81% | - 77% | 5% (2% + 3%) |

| Particles PM1.0 | - 90% | - 84% | 4% (1% + 3%) |

Source: FNTR / Centre interprofessionnel technique d'études de la pollution atmosphérique (CITEPA) – July 2020

Thanks to these efforts – and to the active assistance of the manufacturers, both in reducing fuel consumption and in reducing pollutant emissions – 69% of the French truck fleet in circulation in 2018 complied with the Euro VI standard, the toughest one as regards pollutant emissions for heavy vehicles.

The decarbonization challenge

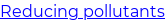

is one thing, but faced with the climate emergency, the priority is to reduce CO2 and other greenhouse gas emissions, especially in road transport (people and freight), responsible for 29% of emissions in France (2019). Of these 29%, 6% are attributable to trucks and 6% to LDVs.

is one thing, but faced with the climate emergency, the priority is to reduce CO2 and other greenhouse gas emissions, especially in road transport (people and freight), responsible for 29% of emissions in France (2019). Of these 29%, 6% are attributable to trucks and 6% to LDVs.

The CO2 equivalent generated per tonne-km has fallen by around 15% since 1990. But it has escaped nobody’s notice that  has increased considerably over the past 30 years. Consequently, CO2 emissions have increased as well (+6% between 1990 and 2019 for trucks, +35% for vans). With freight transport volumes not set to fall in the short to medium term, in particular because of the explosion in e-commerce, the only way to

has increased considerably over the past 30 years. Consequently, CO2 emissions have increased as well (+6% between 1990 and 2019 for trucks, +35% for vans). With freight transport volumes not set to fall in the short to medium term, in particular because of the explosion in e-commerce, the only way to

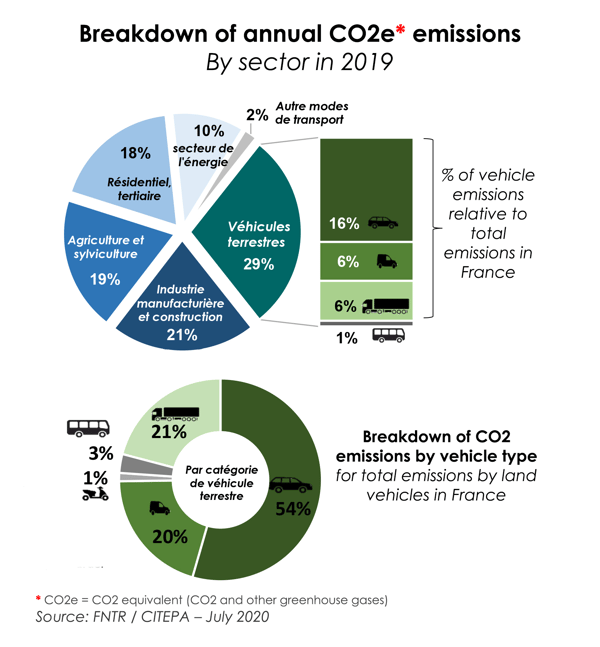

is to tackle the decarbonization of vehicle fleets. The challenge is enormous given the size and state of the fleet as at 1st January 2020 [source SDES 2020]:

is to tackle the decarbonization of vehicle fleets. The challenge is enormous given the size and state of the fleet as at 1st January 2020 [source SDES 2020]:

- The HGV fleet numbers somewhat more than 600,000 vehicles (50.8% of them trucks and 32.6% road tractors)*, and the LDV fleet a little more than 6 million, most of them vans (70%).

- 50% of the HGVs are less than 6 years old, but there are major differences between trucks and road tractors. Whereas the median age of the latter is 3 years, it is 9 years for the former, knowing that the oldest 10% of road tractors are more than 11 years old against 22 years for trucks.

- above all, 95% of vans and 99% of HGVs are still running on diesel!

The least one can say is that the energy reality of the fleet bears no resemblance to what is constantly being asserted and presented as being as good as in the bag, namely: the roll-out of electric drives and the imminence of the transition to hydrogen… This is still a distant prospect, as the change in power systems/fuels since 2011 shows:

NGV, the foremost alternative to diesel?

One cannot but note that the only category that has made strong progress over the past 10 years is NGV fuels and other gases: +837% for trucks and +2,300% for tractors. It is all very encouraging, apart from the fact that the carbon performance of NGV, being fossil in origin, is far from satisfactory. BioNGV’s performance (derived from biomass) is a bit more so (-80% CO2 compared with diesel). But one still needs to be certain of the ability to supply a fleet that is set to expand markedly with biomethane, which appears not to be the case (source Carbone4).

Be that as it may, NGV and its variants (LNG, CNG) are attractive to some haulers. In 2019, for example, the Bills-Deroo Group invested in its first 3 CNG (compressed natural gas) trucks. Its CEO, Jimmy Bils considers the experience to be a positive one. However, he pointed to “a very large incremental purchase cost, because you are talking about 30% or 35% more than a combustion engine. Maintenance is also very expensive. A diesel requires a service every 80,000 or even 100,000 km, whereas with gas technology, a service is required every 20,000 or 30,000 km. That means that the truck needs to be taken out of service for half a day or a day far more frequently during the year.”

On the other hand, in terms of the cost of use per kilometer excluding servicing, CNG is attractive: “With gas, consumption is around 15% lower than for a diesel, and gas is also cheaper. Overall, therefore there is a saving per km of between 15 and 20% on the fuel.” Hence his conclusion: “If you are only looking at saving money, NGV/CNG is not a good option. For us, this choice is part of a genuine, environmentally responsible approach: you emit less CO2 and especially fine particulate matter, which is a real scourge both for us, and nature.”**

Notwithstanding the spectacular increase in NGV trucks and tractors over the past 10 years, the NGV market share remains a tiny minority: 0.84% in 2024 for tractors and 0.44% for trucks. It is even more minuscule in the LDV category (0.05%).

Gas technology will continue to advance, but it has no prospect, even in the medium term, of supplanting diesel, and having any significant impact on freight transport’s carbon balance. What about electric drives and hydrogen about which so much is said? Will these alternatives to fossil fuels deliver on their promises? Are all the conditions in place for them to break through?

This is what we will be examining in a second blog post.

* the remaining 13% are accounted for by specialist vehicles (VASP - specially converted vehicles) for auxiliary transport purposes (road cranes, firefighting vehicles…)

** Speech at the round table event Green Logistics: how to optimize the logistics chain to reduce its environmental impact? At the SiTL 2020 (24 June)